Warning: This is a pretty long analysis.

BWPT made a new low and broke until it reached 90. Some friends have been asking me almost everyday ever since it made a new low. They were getting more and more nervous. Well, so did I.

Well, at any rate, a recalculation of EVA is needed anyway for my early EVA analysis. BWPT is is one of them (CLEO turned out to be faulty). One issue is the tax treatment. BWPT is one basket case where you need to be mindful of taxes. Sometimes companies could defer their tax payments so much that they need to pay hefty taxes even when they are at losses to pay their past taxes. In general, the recalculation for this stock does not change the outlook significantly.

In hindsight, I’m glad I did a thorough analysis. Seeing a clearer picture helps me to remain confident, and writing about it puts my thoughts clearer and organized. As a matter of fact, this is the first time that I make a clear 5 year projection. Most of the time, I do not make projections. I find that most of the time, forecasting beyond next year is a waste of efforts. This is an exception, but it is necessary if you want to invest in a distressed company like this one.

----------------------------------------------------------

Per usual, let’s get some facts first.

Eagle High Plantation (BWPT) EVA is getting worse in Q3 2018. Rising palm oil price which started in May this year clearly has not had effect yet in Q3. It is very likely the result in Q4 is better...just a bit. Overall, 2019 is worse than 2018.

Should I worry? If I look only at its share price and EVA number above, then yes, those are plenty enough reasons to worry. But, the devil is in the details (or more accurately, the angel). There are some good things that have already happened. Their impacts have not surfaced yet (not seen clearly in EVA), but if you understood what has already happened, you will likely agree with me that it is just a matter of time before their impacts could be seen clearly to the sacred EVA number.

The first thing to do is to understand why EVA has slumped especially since 2018. From a breakdown of EVA momentum which I do not show you, it is clear that the decline in EVA starting from 2016 until present is because its EVA margin is beyond worse.

In 2016, BWPT EVA margin is -73%. In Q3 2019, EVA margin is -98%. I have never seen EVA margin as dark as this. As you can see clearly below, the main culprit is because NOPAT margin sucks.

As you might have guessed, this NOPAT margin decline originated from bad gross margin, which is mainly driven by bad palm oil price.

Now, most people already know about this. Bad CPO price, bad margin, bad overall performance. Alright, now it’s my turn to ask the readers the hard question:

“Now that palm oil price has been going up, and if it continues to go up, does it make sense to own BWPT stock? How so?”

That’s a tricky question. If you told me the key value driver to BWPT that makes it worthwhile is better operating margin due to rising CPO price, you only get a half picture right. In fact, I can tell you that better operating margin alone is far from enough to make BWPT share a worthy investment.

Remember, BWPT performance is very dark with EVA margin almost -100%! It takes something like a miracle to prop this company up. Most companies would not be able to do so. But it has something: its plantation has all just matured. This is not new, but I suspect most people could not see the connection why having a just matured plantation could bring a drastic change to Eagle High Plantation value. Most people could only see the connection with sales. As usually is the case, income statement gets all the highlight while balance sheet remains hidden in the dark.

Below is my projection of what could happen to EVA margin if CPO were to rise about 50% from now by 2025. EVA margin would rise by almost 94% to just -4% (yep, still negative EVA. I told you it is very dark). But the most important thing is EVA margin would rise by A LOT, and importantly, more than a half of that EVA margin improvement would come from lower fixed asset charge. Operating margin contributes less than that. This is why if you read my previous analysis, you would see that my biggest concern is if the company adds more immature land. By 2025 I expect EVA margin would soar from currently (Q3 2019) -98% to only -4%. The graph below reveals how it would be achieved.

Why does it make sense? That’s A LOT of improvement coming from fixed assets charge. In most cases, I would scrap such projection. But BWPT is an exception. Fixed assets include plantation value and processing plants. The majority of fixed asset is plantation.

As you can see below, its fixed asset has barely changed since 2014. That’s because BWPT has stopped acquiring lands for plantation. I also see the same trend in AALI which is the largest CPO company in Indonesia. I have read from an industry analysis that it is true palm oil companies have indeed stopped expanding their lands for years (since 2015 or 2016).

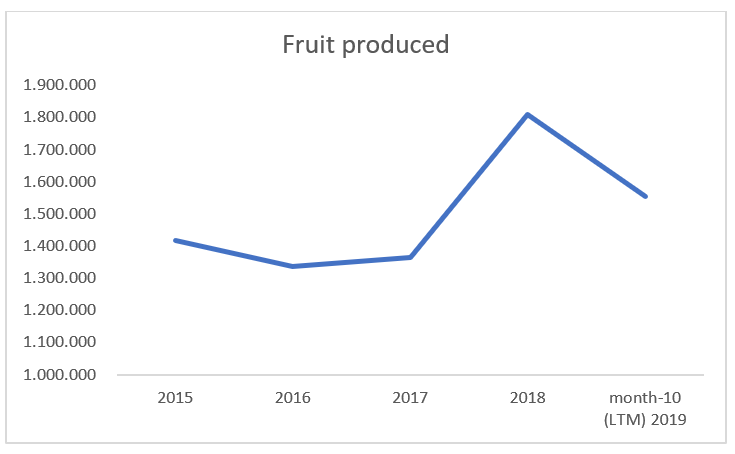

But..take a look at the quantity of palm fruits BWPT has been producing. It’s going up. In 2018, the rise was significant. That was the first year when its plantation has finally matured. Were it not for a long draught this year, it would still go higher.

This is pretty much what I have in mind. Palm fruit production would grow by 12% a year.

*If you carefully look into the data the company gives you on their website (the excel file), you would also find that the company projects fruit production growth by almost 12% next year.*

What’s the basis of such projection? I make a comparison with AALI. I find that AALI’s old-matured plantation produced about 5.5 – 6.0 tons of CPO per hectare. I think that is the potential. In 2018, BWPT plantation could only produce 3.0 tons of CPO per hectare. From that, I conclude that BWPT could produce double at its peak from what it produced in 2018. That peak is 2025. It is an educated guess, so let’s not try to be so precise.

It means that BWPT has a lot of potential to generate more sales from increased fruit production without the need to increase its fixed assets. That has been my thesis a year ago, and the current data supports it. Too bad CPO price has only begun to rise in this year.

The NOPAT margin projection (increasing 43% by 2025) is pretty much a wild guess. Of course, it is still based on data. The last time CPO was at the projected level around 3000 MYR/MT (look below), NOPAT margin was about 20%. Like I said, it is a wild guess. But I’m confident that NOPAT margin will be higher than 15% with gross margin above 30%.

Taking this all together, it means EVA margin outlook for BWPT would look something like this if CPO were to rise by 50%.

Which would translate into EVA projection that is something like this. Yes, even with all of that, BWPT EVA is still a bit negative, so it still a bit of a wealth waster. It is, after all, a major wealth waster company at the present. But, what an improvement!

With such projection, BWPT would score EVA momentum about 8.7% per year until 2025. That’s a magnificent EVA growth. I’ll talk about my thought about this a bit later. By the way, did you notice a sharp rise in EVA in 2020 projection? The EVA momentum for next year according to my calculation is....almost 26%!!! Huge improvement is an understatement. But that is realistic. I don’t make spreadsheets to make fantasy. The key is an improvement in EVA margin which comes largely from better fixed asset utilization. Still a bit confused? I’m feeling a bit generous to explain further the impact of better fixed asset utilization. So, let’s make a special section in the next issue for education material.

Risk of Projection

Let’s talk about risk of projection first.

It goes without saying that this projection needs two things:

1. A good CPO price appreciation (that marked CPO chart)

2. Land potentials like AALI

A naysayer would immediately give thumbs down for both assumptions. Let’s talk about these two things a bit.

First, CPO has already risen quite a bit, so it is on them who need to explain harder why CPO would make a downtrend.

As for me, aside from last year analysis of tighter palm oil supply with increasing demand, I saw a technical signal. It is a major signal that often leads to sharp movement (in this case, up). If you haven’t read it already, you can check that chart & analysis here.

Second, the harvest potential. You know, I bet just because I bring a big shot like AALI here, people would immediately regard it as impossible. For me, I am more confident on this than a continued rise in CPO price. Think about it. The business is planting palm oil trees. How are your lands, seeds, and harvesting skill could be much different from your neighbors?

That being said, the recent drought really concerns me in a lot of ways. The impact is clear: less fruit production. This should be a major concern for investors and managers, but I got the feeling that the palm oil companies just want to pretend that the drought was out of ordinary. What if it isn’t? What if the recent long drought would be the new normal and could only get worse? Climate change is a risk that investors, big corporations, and banks (and some major governments) choose to turn a blind eye. Of course, I hope we don't have such prolonged drought next year.

Afterthoughts

My prediction and analysis have been presented as plainly and transparently as possible. The possible upward EVA trajectory seems like a magic, but it is not when details are presented. Aside from the possibility of CPO price going down, I am very concerned as to what weather would look like next year. Would there be a longer drought? Would long drought become normal? I am more confident on CPO price than palm fruit production.

It’s time to talk about valuation. If you have been reading EVA Brief, you would notice that I would analyze valuation in terms of investors’ expectations. After having reverse-engineering more than 20 share prices, I could attest that a company’s fundamentals and its share price are really linked through discounted cashflows. But there are some exceptions. BWPT is one of them.

Some time ago, a friend of mine asked me “which is more important, EVA momentum or EVA?”. I told him, “it is EVA momentum”. In prior writing, I have written that most of the time, if a company could have a wonderful EVA momentum in sight, then the share price will often keep rising, even when its valuation is already excessive. But, when it rises, the share price is getting more vulnerable to a sharp drop, just as the case in HMSP and GGRM.

That’s how I feel about BWPT. I could see an outstanding EVA momentum on the horizon. I strongly believe that would take its share price higher substantially. But, it would not make sense in a rational valuation standpoint. Of course, an investment that could not be justified in a rational valuation standpoint is a dangerous game. Moreover, I have shown you before: it is very hard for BWPT to be a value creator. It is a risky business to invest in a negative NPV company. Now that I think about it, I think I have invested in a distressed company.

Comments